Go Magazine

Download your free Go! Magazine, packed with information to help you build a healthier workplace and look after your employees in all shapes and forms. In this edition, you’ll get advice on how to support your employees through a new age of technology and the current cost-of-living crisis along with new ways to grow connections, so you can help improve collaboration, loyalty and happiness within your business. Plus, get insights into wellbeing initiatives from the New Zealand Cricket Players Association, the Blues and Z so you can see what others are doing to improve the wellbeing of their people.

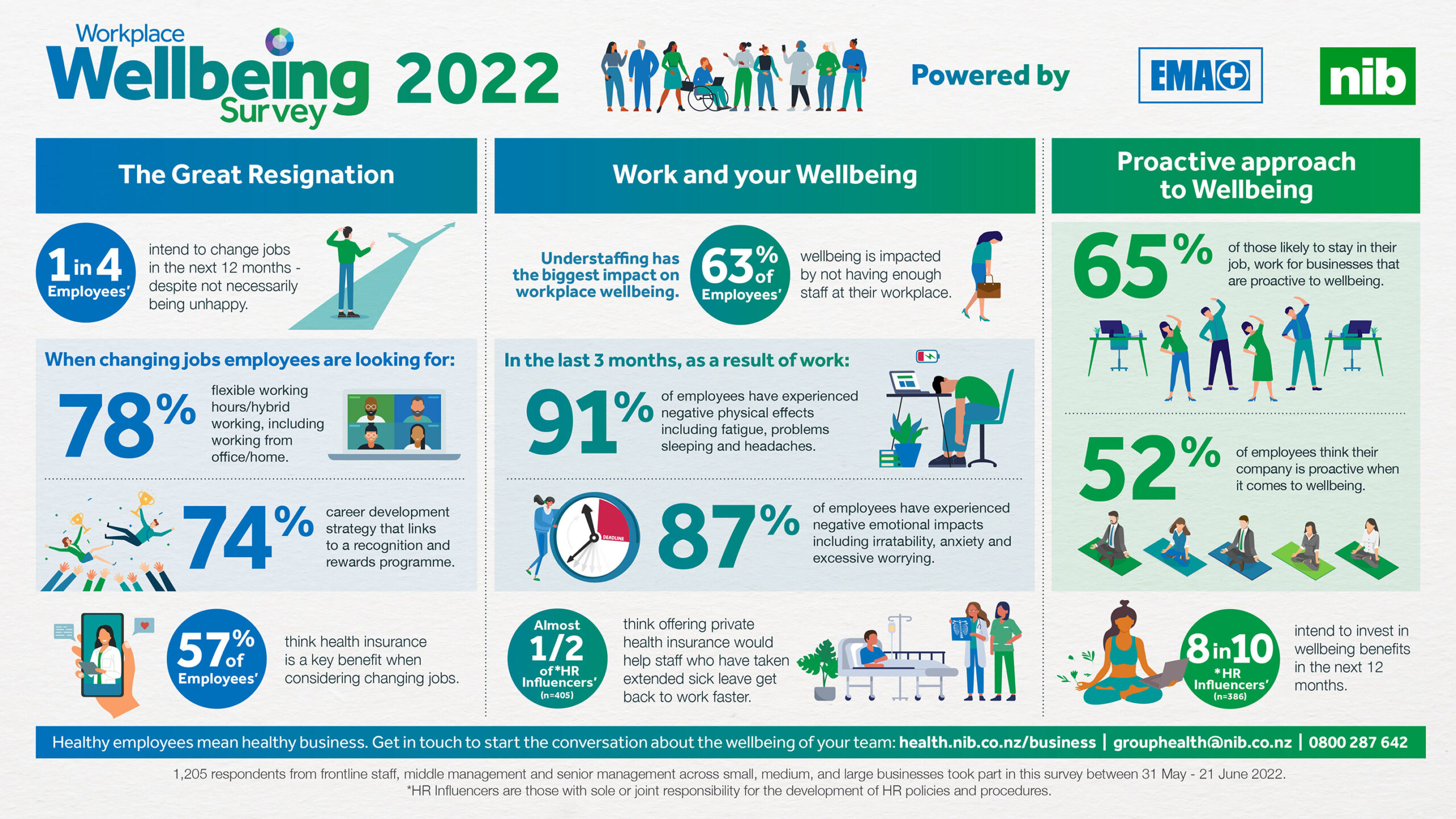

Powered by EMA and nib health insurance

This year’s Workplace Wellbeing survey offers a glimpse into the state of wellbeing in our workplaces, the health and attitudes of employees, and the role health insurance has to play.

We surveyed 1,205 workers, comprising of senior management, middle management, and frontline staff across small, medium, and large businesses.

Below is a snapshot of the key findings, providing insights into how employees are feeling and what they are looking for from their employer.

Looking after your employees’ wellbeing

nib Business Health Insurance supports employees to perform at their best. Hear from Harry Plummer, Karl Tu’inukuafe and Tom Robinson from the Blues as they share their experiences with how nib Business Health Insurance through New Zealand Rugby Players Association gave them peace of mind that they’d get the nib covered treatment they needed, quickly, so they could get back to playing the sport they love.

Look out for the ‘In Your Corner’ series across nib New Zealand channels, and read more about the Blues’ stories.

Emily Cleland, Managing Director at HD Geo, a small engineering consultancy in Hamilton, chose a nib group policy to take the burden of health concerns “out of the picture” for her employees.

Thanks to nib’s group cover for pre-existing conditions, Principal Environmental Consultant Terre Nicholson, was able to access immediate treatment when her cancer returned.

Small business, big benefits!

nib can now offer EMA member businesses of five or more employees the same access to big benefits usually reserved for groups of 15+ members, including:

- Immediate pre-existing conditions cover (excluding general exclusions, and Serious Condition Lump Sum option).

- Waived stand down periods on GP, Dental & Optical and Specialist Options when added within 90 days of policy commencement.

- Extension of concessions to immediate family members of employees, when added within 90 days of policy commencement or marriage.

Find out more

Sign-up is easy as!

Workplace wellbeing isn’t the only thing on your plate, so we’ve made signing up organisations a simple 3 step process. This video explains how.

Get covered today

In partnership with the EMA

In our experience, no two people or organisations have precisely the same needs. Put simply, the better we know you, the better we can do for you. So, when we think about partnering with you, very simply, the first thing we do is listen. And we believe EMA’s people, safety and innovations events will help your business increase productivity and unleash the potential of your people.

At nib, we’re all about great partnerships. We support EMA as we believe, much like your people, your business needs to be in fighting fit form. Our corporate health solution is geared to do just that for your people – helping them keep safe, supported and healthy. And we’ll work with you to communicate the true extent of this value to your team. So, get in contact with us and let us start listening.